We’ve been closely reviewing the stocks of Accenture and Salesforce. Both appear to be under pressure, with valuations taking a hit amid the ongoing AI hype. For many investors, the uncertainty lies in how consulting and SaaS services will evolve in an AI-driven world—and whether these business models still have a strong future. This unpredictability may be contributing to the recent decline in their stock prices. The key question now is whether this presents an attractive opportunity to accumulate more shares, or if it’s wiser to wait and see how their ongoing business transformations ultimately shape their long-term prospects. Let’s take a deeper look at both companies.

*At Dollar Clarity, we do not engage in predicting or forecasting the future prospects of businesses—especially when it comes to mature or well-established companies. Instead, our approach is to identify the reasons why a stock may be beaten down and then focus on the company’s current fundamentals. By analyzing whether the stock is undervalued or overvalued at its present pricing, we follow the principles of value investing—a strategy that emphasizes patience, discipline, and a lower-risk path to building wealth.

Lets deep dive into the numbers.

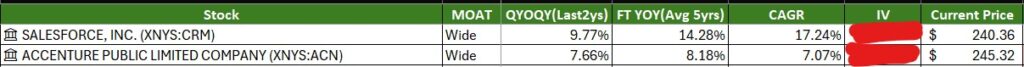

Our intrinsic value estimate for Salesforce currently stands at $xxx.xx, suggesting that the stock is undervalued compared to its current market price of $240.36. In contrast, Accenture, trading at $245.32, appears slightly overvalued relative to our intrinsic value of $xxx.xx. With valuations across the broader tech sector on the rise, these two beaten-down stocks have certainly captured our attention.

We based our analysis on both historical growth trends and reasonable projections of future growth, assuming these companies remain as relevant as they are today. For Salesforce, the market is effectively pricing in the need for sustained annual growth of around 17% to justify its current valuation. In comparison, Accenture would only need to grow at a more modest rate of 7.07% annually to maintain its valuation.

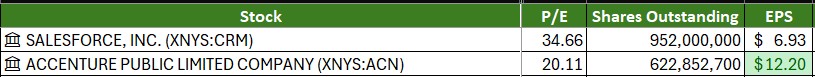

Accenture also trades at a lower P/E ratio and delivers a higher EPS, which may represent stronger value for investors. It is also one of our all-time favorite companies (ACWL—a company we love). Even if Salesforce were to initiate buybacks to reward shareholders, with the same number of outstanding shares, Accenture is still generating more earnings at present.

Plus, ACN is giving out a 2% dividend as of its current pricing. Who doesn’t love that?

Whether to buy or not, depends on your further analysis. We normally keep our analysis simple and try to share 1-2 simple points so you do not need to read an extensive number of pages to determine if the business is right for you.