Stocks don’t always reveal their true potential at first glance. In fact, identifying value often requires seeing things that others may overlook. Take JPMorgan Chase (JPM), for example. The business has historically commanded a steady compound annual growth rate (CAGR) of around 10%. For the first three quarters of this year, the company has reported approximately 7% growth in earnings.

While it’s important to keep investment strategies simple, it’s equally essential to dive deeper when assessing a company’s intrinsic value, especially in today’s market. The key lies in understanding the full picture of a business’s current standing and future potential.

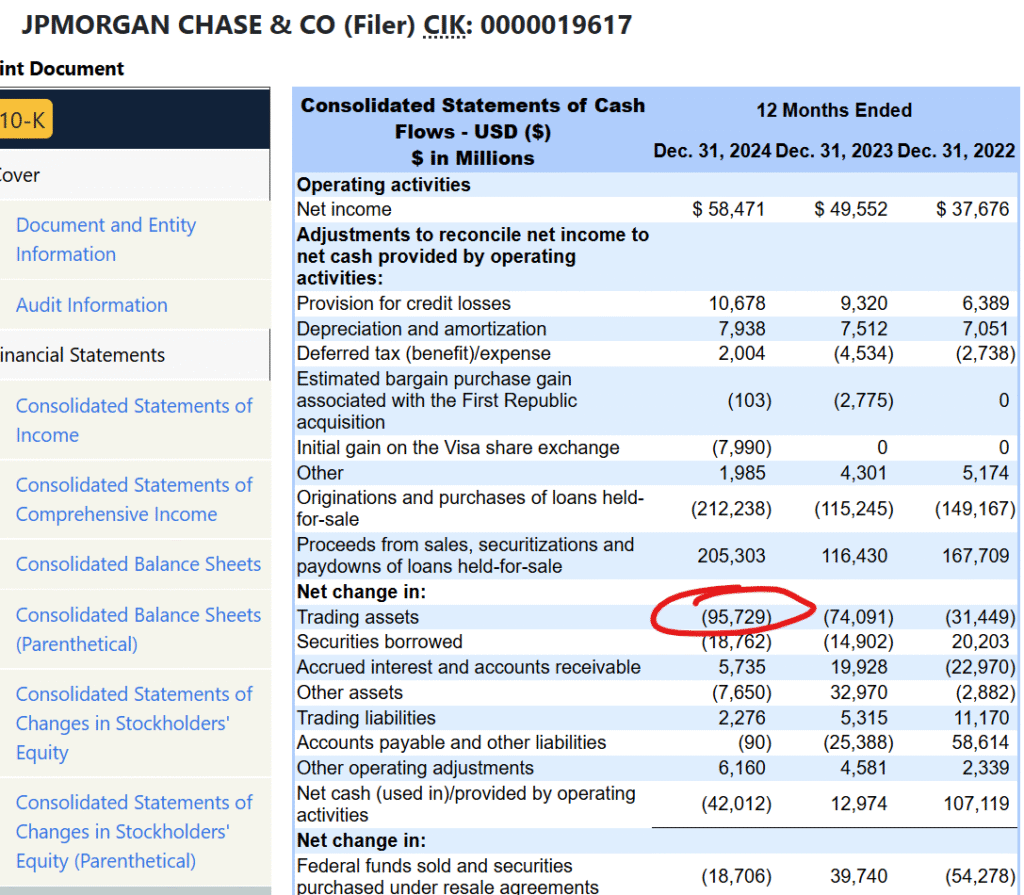

Despite JPMorgan’s stock reaching an all-time high, we believe it has not yet fully realized its true potential. Our intrinsic value estimate for JPMorgan stands at $581.98, significantly higher than its current trading price of $311.12. While revenue has consistently increased year over year, some investors may be concerned about the company’s high negative cash flow, a common area of focus for financial analysts.

However, a closer examination reveals that this negative cash flow is largely due to a high negative change in working capital, which is typical for banks—especially large ones like JPMorgan. While this might raise questions, it’s important to recognize that such fluctuations are not inherently problematic. In fact, they are often part of the bank’s day-to-day operations and overall financial strategy.

For those concerned with cash flow metrics, we’ve dug deeper into JPMorgan’s financials and uncovered a crucial detail: the company has been quietly increasing its holdings in trading assets. This move could signify long-term growth potential, even if it doesn’t immediately reflect in traditional cash flow statements.

In fact, up until 2025, JPM is still acquiring short term trading assets to invest.

In conclusion, while JPMorgan Chase continues to trade near record highs, its fundamentals suggest there may still be untapped value beneath the surface. Short-term fluctuations in cash flow or working capital shouldn’t overshadow the bank’s long-term strength, consistent growth trajectory, and strategic asset accumulation. For investors who look beyond headline numbers, JPMorgan represents more than just another blue-chip stock — it’s a business steadily compounding value and positioning itself for continued success in the years ahead.