When you rely on simple, time-tested metrics to decide whether a stock is good or bad, it helps cut through the noise and eliminate procrastination. The key to investing is to get your money working — not waiting on the sidelines. A good deal always comes down to buying at a good price. Of course, determining what’s “good value” can be tricky — but here’s how you can think about it.

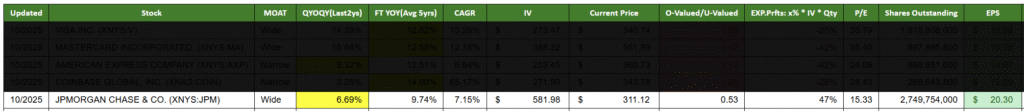

Take JPMorgan Chase (JPM), for example. With a P/E ratio of just 15.33, this business generates roughly $20.30 per share annually across its more than 2 billion outstanding shares — that’s an enormous stream of earnings. Based on even a conservative 7% growth rate, its fair valuation still sits at roughly half of its current market price.

That kind of mismatch between price and value makes dollar-cost averaging (DCA) into JPM a smart, steady strategy — even as the stock continues to climb.

Many more stocks in our list. We don’t blindly add stocks to our list, we mine only the best stocks to analyze so you cut through the noise and focus on only those that you will really only consider putting into your basket.

Because in the long run, value always wins.